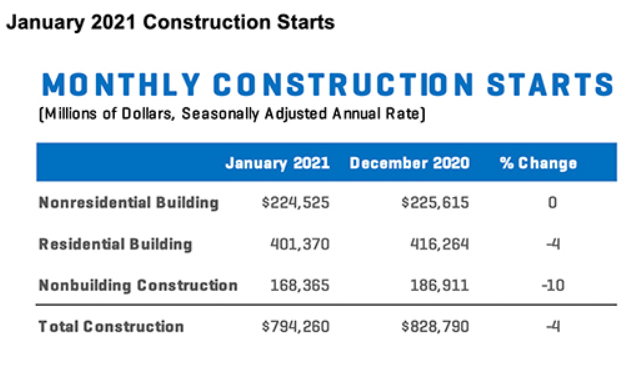

Total construction starts dropped 4 percent in January to a seasonally adjusted annual rate of $794.3 billion, according to Dodge Data & Analytics. Residential starts were four percent lower in January, nonresidential building starts were flat and nonbuilding starts dropped 10 percent. From a regional perspective, starts were lower in three of the five regions – the Midwest, South Atlantic, and South Central. Starts rose, however, in the Northeast and West.

Total construction starts dropped 4 percent in January to a seasonally adjusted annual rate of $794.3 billion, according to Dodge Data & Analytics. Residential starts were four percent lower in January, nonresidential building starts were flat and nonbuilding starts dropped 10 percent. From a regional perspective, starts were lower in three of the five regions – the Midwest, South Atlantic, and South Central. Starts rose, however, in the Northeast and West.

For the 12 months ending January 2021 total construction starts were 11 percent below the 12 months ending January 2020. Residential starts were 5 percent higher for the 12 months ending January 2021, while nonresidential starts were dropped 25 percent and nonbuilding starts fell 15 percent. In January, the Dodge Index lost four percentfrom December.

“The tenuous beginning to construction starts in 2021 highlights the long and rocky road ahead for the sector this year,” saysd Richard Branch, chief economist for Dodge Data & Analytics. “Over the course of the year the economy will recover as more Americans receive their vaccinations. However, the construction sector’s recovery will take time to materialize due to the deep scars caused to the industry by the pandemic. Patience will be key in the months to come.”

Residential building starts fell four percent in January to a seasonally adjusted annual rate of $401.4 billion. Multifamily housing starts were seven percent lower, while single family dropped three percent.

For the 12 months ending January 2021, total residential starts were five percent higher than the 12 months ending January 2020. Single family starts gained 12 percent, while multifamily starts slid 12 percent on a 12-month sum basis.