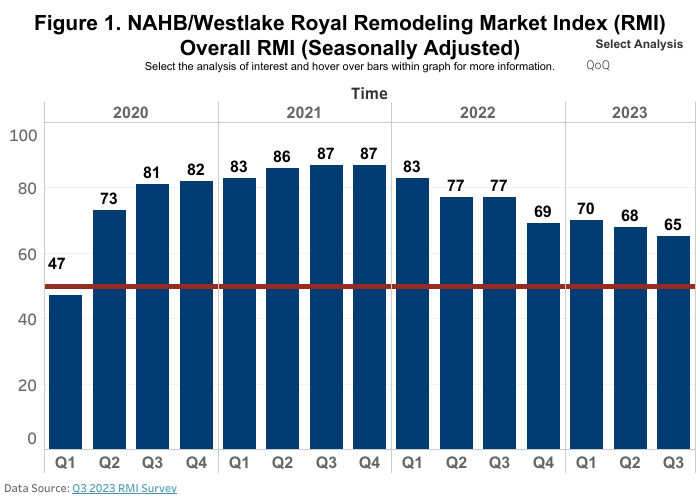

The National Association of Home Builders released its NAHB/Westlake Royal Remodeling Market Index (RMI) for the third quarter, posting a reading of 65, declining three points compared to the previous quarter.

While there is still demand for remodeling, some customers are pulling back on potential projects due to higher prices and increased interest rates. Even though remodeling spending has experienced some slow down over the past year, it accounts for 43% of total residential construction as of June 2023, up from 31% at the beginning of 2002. NAHB forecasts that the remodeling market will experience mild growth in 2024 and 2025.

About the RMI

The RMI is based on a survey that asks remodelers to rate various aspects of the residential remodeling market “good,” “fair” or “poor.” Responses from each question are converted to an index that lies on a scale from 0 to 100, where an index number above 50 indicates that a higher share view conditions as good than poor.

The RMI is an average of two major component indices: the Current Conditions Index and the Future Indicators Index. The Current Conditions Index is an average of three subcomponents: the current market for large remodeling projects ($50,000 or more), moderately-sized projects ($20,000 to $49,999) and small projects (under $20,000).

Current Conditions Index

In the third quarter of 2023, the Current Conditions component index was 72, falling five points from the previous quarter. Quarter-over-quarter, all three subcomponents decreased with both large and small remodeling projects declining five points to 67 and 76, respectively, and moderately-sized projects falling four points to 73.

Future Indicators Index

The Future Indicators Index is an average of two subcomponents: the current rate at which leads and inquiries are coming in and the current backlog of remodeling projects. In the third quarter of 2023, the Future Indicators Index was 57, which is three points lower than the previous quarter. Quarter-over-quarter, the current rate at which leads and inquiries are coming in dropped three points to 56 and the backlog of remodeling jobs decreased by two points to 59.

NAHB’s take on the data

“While there is still demand for remodeling, we are seeing some customers pull back a bit, especially for larger projects, due to higher prices and increased interest rates,” says NAHB Remodelers Chair Alan Archuleta.

“Although the RMI is down slightly, it remains in positive territory,” says NAHB Chief Economist Robert Dietz. “The remodeling market, less impacted by interest rates, continues to outperform new construction, increasing from 31% of total residential construction in 2002 to 43% in second quarter 2023.”