GlassBuild Is Back: Attendance and Show Floor Return to Pre-Pandemic Levels

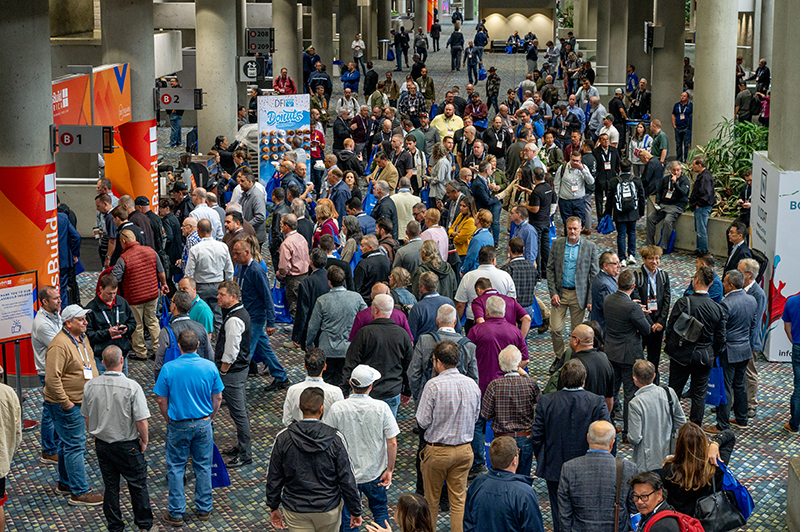

You could say that the theme of the 20th edition of GlassBuild America was “more” — more exhibitors, more attendees and more envelope-pushing innovations. The show, which concluded Nov. 2 in Atlanta, Georgia, may also represent a return to the upward slope of 2019: the 2023 edition welcomed over 480 exhibitors compared to 2019’s 420, and opened its doors to 8,700 attendees this year, compared to around 8,200 at the last show before the pandemic. Attendees arrived from all 50 states and 65 countries this year.

“The show has been great for us,” says Daniel Carpey, president, Orchard Lock Distributors. “It’s a great connection point. We’re here to connect with friends and partners, year after year.”

Here are the major takeaways from Window + Door's editors.

Automation expands into new manufacturing processes

Glass and fenestration machinery continues to emphasize long-term savings in terms of productivity over short-term cost. Companies showcased machinery for all parts of the production process, including operations that have traditionally been difficult or unusual to automate.

Erdman showcased its partnership with FlexScreen, a flexible insect screen composed of continuous, solid-core, spring steel wire. Automation of the product’s insertion into fenestration systems is straightforward, says Morgan Donohue, vice president of sales and marketing, Erdman, partly because the steps are similar no matter the screen size. Like most automation, it also saves on labor and increases productivity. “You can produce one completed system every 13 to 15 seconds with only four people,” says FlexScreen President Joe Altieri.

Speed, especially of more complex processes, continues to drive fabrication automation. Emmegi highlighted its door blank processing machine, which allows window and door fabricators to process a full door blank, instead of one profile, which is critical for a project’s schedule, says Chip Steele, North American Sales. “Door fabrication typically holds up production for large jobs,” he adds, often because architects want custom hardware, which can create a delaying back-and-forth with the supplier.

The market demands big, and bird-friendly, glass

Glass is not getting any smaller, according to GlassBuild exhibitors. “The demand for heavy, thick doors is increasing, especially impact-rated options,” says Alfonso Sing, senior product manager, CRL.

Diamon-Fusion International expanded its FuseCube Express Machine specifically to accommodate larger glass sizes, says Carl Christ, vice president, technical services and business development. “Glass is getting bigger and bigger. We don’t really see an end in growth,” he says. “Customers want big sizes and narrow sightlines,” says Greg Koch, vice president of sales and marketing, Deceuninck North America.

Bird-friendly glass applications and innovations also continue to expand. That growth was demonstrated at Guardian Glass’s booth, where Alan Kinder said the company offers several bird-friendly glass products for various cost options. Guardian offers a UV-coated option as an alternative to the dot pattern. Kinder says the glass has seen adoption in multifamily projects in New York City due to local legislation that mandates the use of bird-friendly materials. While legislation is currently localized, he predicts that more bird-friendly building legislation will continue to be adopted nationwide.

Hegla showcased its laser-applied dot-pattern bird-friendly glass, available in different dot spacings and sizes. The company’s sales manager, Tom Bechill, says that concerns remain among architects about the aesthetics of bird-friendly glass, for humans looking at the installed glass. “We need to educate architects about visibility, and what can actually be seen by humans,” he says.

New products highlight ease of installation, ease of use

It’s not just machinery that’s increasingly automated, but also fenestration systems and hardware. Several companies showcased automated and/or electronic sliding doors, locking mechanisms and more. Orchard Lock’s Carpey cites the pandemic as the major reason for greater adoption of electric and touchless automated hardware and entry options. He says demand is strong for multifamily applications, especially since they’re being used by younger people comfortable with mobile technology. “Much of the automated systems work through your phone, and that’s attractive to young people.”

By contrast, Greg Koch, vice president of sales and marketing, Deceuninck North America, says that older adults are a major demographic served by increasing automation. “We have an older society that needs options to be automated,” he says. The company’s automated sliding door can be operated by iPhone, and even by a pet collar outfitted with a sensor.

In addition to ease of use for the end-user, ease of installation continues to be a trend. C.R. Laurence showcased several systems designed to be easy for glaziers to install. Systems and hardware are designed to be adjustable in the field, says CRL’s Sing, allowing for a smaller margin of error.

Pandemic woes linger as recession looms

Feelings were optimistic on the busy show floor and, in many ways, appeared to signal a return to normal, pre-pandemic business. “The North American market is back to pre-COVID levels, but the European market is soft,” says Ron Crowl, general manager of window, door and glass, Cyncly.

Nevertheless, some exhibitors are preparing for a shift in the market and potential downturn, as was predicted in GlassBuild’s annual economic forecast. “Architectural contracts backlogs are down to six months, and interest rates are still affecting big projects,” says Emmegi’s Chip Steele. “Replacement windows and the remodeling market are likely to increase.”

Inflation and costs have also lead to a smaller residential footprint, says CRL's Sing. New construction residential footprints have shrunk by 7%, he says, and products will need to accommodate new sizes.

While supply chain was not top of mind for exhibitors, difficulty still exists for some machinery parts, says Hegla’s Tom Bechill. “Trucking is better and steel [supply] is better, but the electronic supply chain is still behind,” he says. “They got so behind during COVID and could not add more capacity, that they haven’t caught up yet.”

Energy efficiency pushes product innovation in Energy Star 7.0, global warming potential

Energy efficiency remains a large topic for commercial and residential products and systems. The recent adoption of Energy Star 7.0, which went into effect on Oct. 23, was top of mind for some customers, say exhibitors.

“Customers are asking about Northern zone requirements [for Energy Star], and whether or not they need triple pane,” says Darlene Aldred, business manager, Guardian Glass. “We’re helping them understand that it really depends on the frame.” Aldred says companies are trying to “stay ahead of the game,” preparing for energy-efficient standards like California Title 24.

“Warm-edge [technology] is here to stay,” says Joe Erb, commercial sales specialist, Quanex. “There’s now more literacy in the market about next-gen solutions.” He says he’s also seeing more commercial vinyl in the market, and that increased applications will depend on educating architects about performance.

Architects continue to focus on global-warming potential, says Anissa Flinckinger, manager, Vitro Architectural Glass. She says the company is working to educate architects on the high-performance potential of glass in terms of long-term operational performance. Flinckinger sees U-values becoming increasingly important to performance due to standards like the Massachusetts stretch codes.