2023 Industry Pulse | Sustainable Slowdown

As the supply chain stabilizes, the single-family housing market slows. Nevertheless, the industry charges forward with new sales, product innovation and investments

The past two years have been characterized by historical challenges and uncertainty, especially around material availability, supply chain and labor. Amid the challenges, demand kept climbing as the residential new construction and remodeling markets strengthened.

Going into 2023, however, the single-family residential market is weakening. Housing affordability is at a 10-year low, builder confidence is at its lowest reading in more than a decade and housing starts are posting a calendar year decline for the first time since 2011.

This year’s Industry Pulse report reflects that waning confidence and hints at some new trials in the year to come. Although it appears as though supply chain and material challenges are easing, labor remains a struggle and many companies expect to put in extra work to have just a flat year of sales and avoid a negative year.

Uncertainty of the coming year colors most conversations and predictions. But amid that uncertainty is a near universal confidence that any recessionary period and slowdown the industry hits will be temporary.

“There is no doubt that inflation and rising interest rates are negatively impacting our industry,” says Joe Peilert, president and CEO, Veka North America. “On the other hand, we know that market fundamentals and increasing home values are tail winds that will eventually win out. For 2023, we anticipate that the renovation and replacement business will do better than new construction business, though not enough to sustain the elevated demand levels we have experienced in 2021 and the first half of 2022.”

Opportunities & Challenges

Biggest Opportunities for 2023

- Customer service

- Improve cash flow

- Improved supply chain

- Reduced material costs

- Sustainable products

- Better thermal breaks

- Quickly react to market disruptions

- Gain market share

- Refine and improve products

- Broaden sales area

- Lean manufacturing and process improvements

- Software

- Automation

- Employee retention and training

- Secure and grow backlogs

Biggest Challenges for 2023

- Reduced volume

- Sales growth

- Interest rate increases

- Finding and training employees

- Inflation

- Controlling costs

- Securing constant, quality suppliers

- Production capacity

- Increased energy costs

- Material shortages

Sales

Although sales remained strong in 2022, they didn’t overwhelmingly exceed expectations as in 2021. While last year’s survey indicated great optimism among companies for 2022 sales expectations (80 percent anticipated increased sales), not even 50 percent of this year’s respondents anticipate increased sales in 2023. Just over half anticipate flat or decreases in sales.

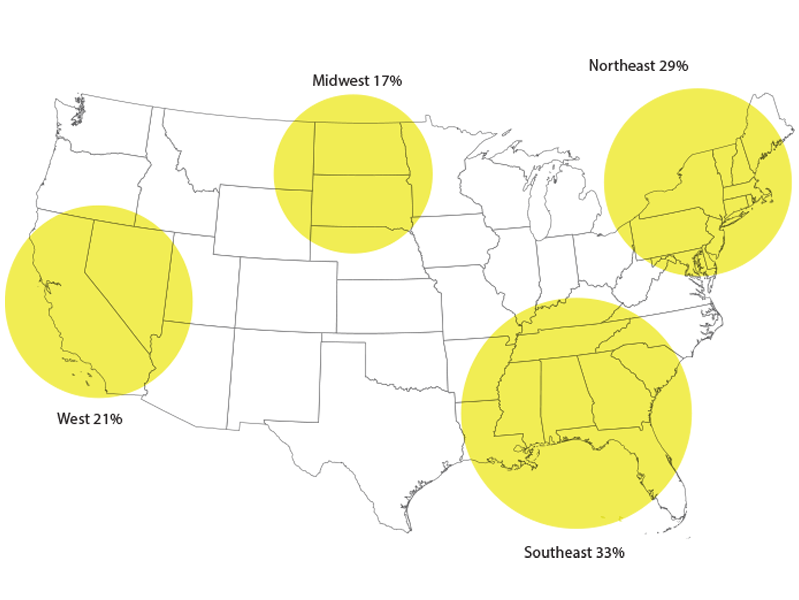

Which geographic area do you expect to see the most growth in 2023?

Sales Facts

69%

Higher than or as projected (all respondents)

72%

Profit margins stayed consistent or increased year-over-year

31%

Expect sales to increase moderately in 2023

“We’re looking at about a seven to 12 percent drop in volume with our core market and customer base,” predicts Dan Gray, director of sales, North America, Roto Frank of America Inc. “We’re actively in pursuit of new business to buffer a portion of that projected decline. We’re finding what we did during the pandemic, our competition has done as well, such as bolstering internal production capacities and being aggressive in the market seeking new business. Customers are looking to reduce costs, which means a very competitive situation for pricing.”

Larry Johnson, VP of sales, Quanex, predicts the industry to be down 16 to 20 percent, based on what he hears from his large customers. “We’re hoping at least it’s a flat year and not a down year,” he says. “We’re projecting a little bit of growth, but not any kind of serious growth. We want to be conservative going into this year.”

Gray notes the changing sales landscape. Virtual meetings became the norm when the pandemic hit in 2020, but that’s changing. “You cannot actively sell over Teams or Zoom in a virtual world,” he says. “You can retain business with existing customers, but to foster new relationships and sell new programs you need to be face-to-face.”

Darlene Aldred, residential segment marketing manager, Guardian Glass Americas, also observes the changing sales landscape. “Our customers’ needs are evolving from wanting a straightforward sales relationship to seeking a strategic business partner. They want us to provide products plus the technical expertise to help them with immediate needs, as well as long-term to help them determine how far they can go.”

Companies with North American manufacturing locations may also have an advantage. “A lot of customers prefer to have North American manufacturing in their supply network today [after the extended lead times during the pandemic when you brought goods from overseas],” explains Gray. “If you can get your product closer to the hands of the customer, the more positively it will be received.”

“Any time a market retracts, you’re always looking for potential new business relationships,” says Mike Turner, senior vice president of sales and marketing, YKK AP America. “Supporting our core customer base is our first priority, but to continue growth mode in a declining market we have to cast a wider net and look for new relationships that can help us continue to meet our sales objectives.”

The slowdown is giving companies a welcome respite from a hectic few years. “As of now, our customers appear to be welcoming the chance to catch up on their backlogs,” says Moore. “Builders appear to be simplifying their offerings, including windows and doors.”

Product Trends

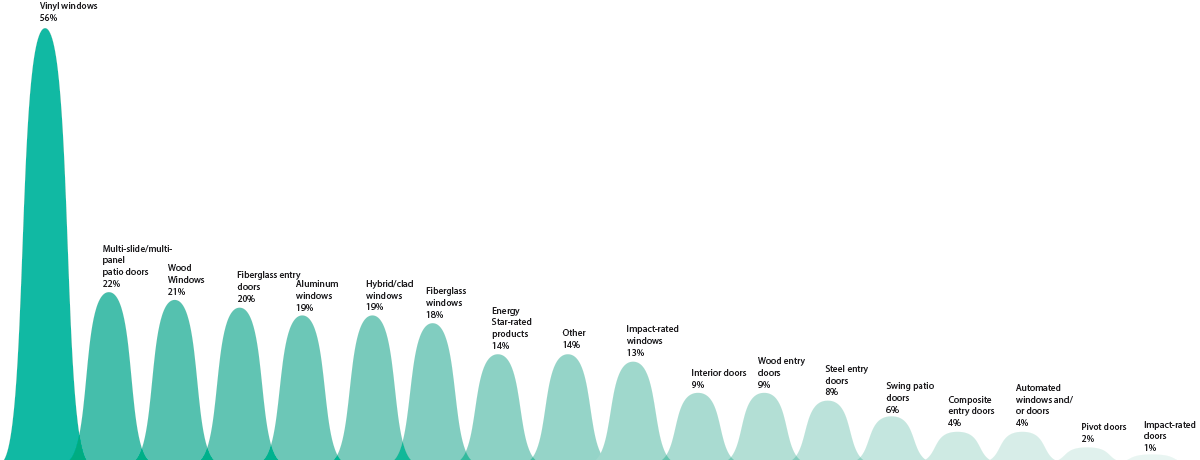

Which products were most in demand in 2022?

*Respondents could select more than one option

Top 10 most demanded products

- Vinyl windows 56%

- Multislide/multi-panel patio doors 22%

- Wood windows 21%

- Fiberglass entry doors 20%

- Aluminum windows 19%

- Hybrid/clad windows 19%

- Fiberglass windows 18%

- Energy Star-rated products 14%

- Other 14%

- Impact-rated windows 13%

Above: The most demanded fenestration products in 2022.

Product Facts

64%

Companies that offered new products in 2022

82%

Companies that plan to offer new products in 2023

54%

Plan to update Energy Star-certified products

What drove innovation in product development in the past year?

- Efficiency

- Consumer demand

- Color

- Changing aesthetics

- Unreliability of component supply

- Code compliance

- Affordability

- Ease of installation

- Thermal and structural performance

- Automation

- Market expansion

Trends

Vinyl windows remain the dominant in-demand product, according to the survey results, with multi-slide and multi-panel doors coming in a distant second. Those doors grew in popularity compared to last year, following the industry trend of indoor-outdoor living spaces and customers asking for ever-increasing expanses of glass in their homes.

As always, though, customers drive product development. “It is always and forever our customers,” says John Moore, vice president of marketing, GED Integrated Solutions Inc. “We meet with customers on a regular basis and listen to their feedback on productivity, labor savings, costs and quality.”

Finished product manufacturers also aim to innovate and meet customer needs. Pella, for example, launched a hidden screen in its vinyl window line that Nicolle Picray, public relations and brand communications manager for Pella, describes as a “homerun for us.” The reported success of that product piggybacks on Pella’s easy-slide operator for casement and awning windows.

Design-wise, Pella plans to invest in its wood product lines. “We’re starting to see trends that have expanses of glass and wood, which is great for expansive glass and high-end design,” says Picray.

Those larger sizes impact products in every part of the supply chain. “As windows and doors continue to be specified for larger, taller, wider, heavier sizes, you need hardware that keeps pace with those trends in the marketplace,” explains Gray. He also says customers are looking for new solutions to give them a competitive advantage. “A lot of expectations are being put on hardware suppliers today,” he says.

Suppliers also often need to develop products that can meet multiple goals. “Developing products that support ever-changing codes and standards is at the forefront of AmesburyTruth’s design process,” says Michelle Nissen, VP of product management, AmesburyTruth. “We are also focused on enhancing our product offering that addresses housing affordability by providing solutions at various price points. Finding solutions that meet both objectives are driving our new product development efforts.”

What technologies are you considering to enhance the efficiency of your products?

*Respondents could select more than one option

- Fourth-surface low-E 31%

- Triple pane 27%

- Other 21%

- Gas fill 20%

- None 20%

- Thermally broken aluminum 15%

- Skinny triples 11%

- Concealed hardware 11%

- Aerogel 7%

Energy efficiency

Energy efficiency is top-of-mind for many companies, especially as the October deadline for the implementation of Energy Star Version 7.0 approaches. These guidelines are causing companies in every sector to consider their product offerings. “Energy Star 7.0 will disrupt the industry in 2023,” predicts Moore.

Johnson expects the cost of upgrading products to meet Energy Star Version 7.0 criteria will cause some companies to allow their certifications to lapse or have just one window system be Energy Star certified with the remaining systems having standard thermal values.

Picray notes Pella’s involvement with industry organizations to help set the standard for what energy efficiency should look like. “Our team is always trying to understand is that as energy standards evolve, where is the right place for that energy efficiency to live in the market,” she queries. “There’s only a certain level of energy efficiency achievement in our products that is also cost effective for us and the customer. The customer will pay only so much for energy efficiency improvement; anything we create that is better efficiency outside of that will have a hard place finding a place in the market.”

Greg Koch, vice president of sales and marketing, Deceuninck North America, says its new product development is driven by one word: sustainability. “Everything we’re doing is with a focus on sustainability and our commitment to a greener built environment,” he says. “Within that larger mission is a staunch commitment to product performance, energy efficiency, and hurricane and impact resistance.” He also notes the need to effectively recycle products within customers’ and their own waste streams.

Complying with Energy Star Version 7.0 is also a big focus for the company, he says.

Deceuninck has several product lines designed to enhance thermal performance in window and door systems and curtain walls. Opportunity also exists to marry the high-performance PVC products with the trendy dark colors. “Our R&D efforts are focused on high-performance PVC products extruded in dark colors,” he says.

Koch also explained Deceuninck’s carbon zero commitment. “Globally, Deceuninck Group has committed to reducing our carbon dioxide emissions by 60 percent by 2030,” he says. “Factoring in the anticipated growth of the business, this equates to a reduction of up to 75 percent in carbon dioxide for each ton of material produced. We are taking these steps now with the goal of operating at net zero by the year 2050.”

Embodied carbon in products is also on the industry’s radar. “In general, less carbon is better, but you have to consider use phase when talking about windows,” explains Kevin Seiling, VP engineering, Veka North America. “If you only consider glass, for example, all windows would be single-glazed because it would double the carbon if you go from single- to dual-glazed. If you consider the use phase, a dual-glazed window would certainly cut the U-value in half and lower the SHGC substantially. Depending on the climate zone, orientation, size, etc., the use phase can easily make up for the added carbon from the extra layer of glass.”

Aldred also distinguishes between embodied and operational carbon. “Manufacturers have to look at carbon through two lenses,” she explains. “We can help reduce embodied carbon in building products via researching and developing ‘lower’ carbon materials; however, we must also ensure our products support the efforts of the building design and construction team to reduce operational carbon of the building in a manner that still provides aesthetics and comfort and contributes to the overall wellbeing of the occupants.”

Where will you focus product-development dollars in 2023?

*Respondents could select more than one option

- Energy efficiency 42%

- Functionality 42%

- Technology and other “smart” functions 31%

- Aesthetics 26%

- Other 20%

Materials and Supply Chain

How much did material prices increase?

- 0-15 percent 35%

- 15-30 percent 44%

- 30-45 percent 14%

- 45-60 percent 6%

- More than 75 percent 1%

What materials are most difficult to acquire?

*Respondents could select more than one option

- Components 33%

- Hardware 31%

- Glass 28%

- Other 19%

- Aluminum 16%

- Paint 16%

- Chemicals 15%

- Vinyl 14%

- Wood 14%

- Sealers/spacers 9%

Has material availability caused you to re-engineer products or change product offerings?

- Yes 47%

- No 39%

- Prefer not to say 14%

Companies have had to substitute materials or revise design to fit available hardware. One respondent stopped making an aluminum window line because of steep price increases and material availability and another designed internal manufacturing processes for assembled products previously bought from second parties. Yet others dealt with discontinuation of raw materials and had to find replacements to meet performance goals.

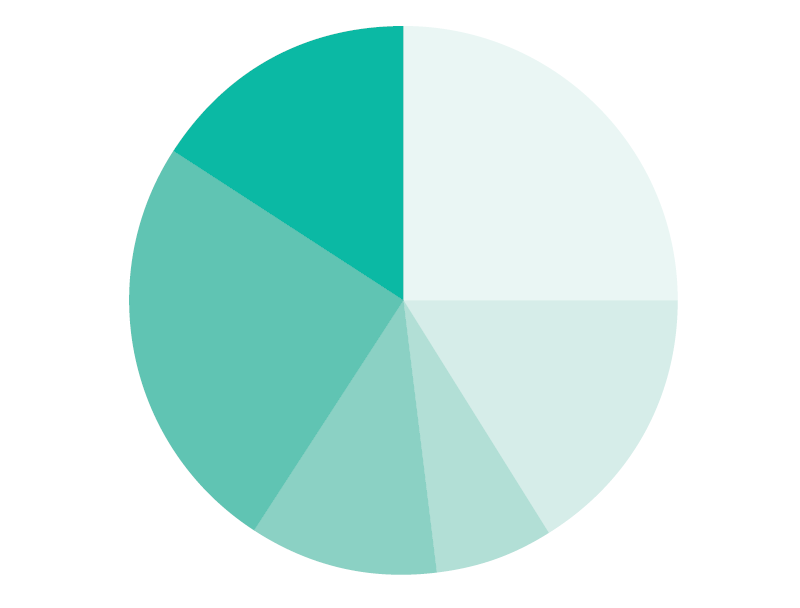

How far out is your backlog?

Counterclockwise, starting at the top of the chart, respondents report backlogs:

• 1–2 weeks 16% • 2–4 weeks 25% • 4–6 weeks 11%

• 6–8 weeks 7% • 8–12 weeks 16%

• Longer than 12 weeks 25%

Materials & Supply

96%

Companies that saw prices increases in 2022

72%

Expect material prices to increase in 2023

65%

Tried a new supplier in 2022 & will try a new supplier in 2023

Additionally 72% of respondents indicate they have strategic alliances in the supply chain and cited top benefits that include shorter lead times, inventory, quality and availability, consistency, honesty, loyalty, communication and order fulfillment.

Material prices increased last year and will likely continue their upward trend this year, according to the survey results. Despite the pain points of increased costs, companies indicate supply chain and shipping constraints are easing and no longer is it so difficult to acquire the necessary materials to manufacture products.

“Materials procurement challenges are decreasing, and availability is improving across all commodities with metals improving the fastest,” says Bob Burns, president, AmesburyTruth. “Lead times are reducing as well. The challenges are primarily in very specialized materials or components and a few materials originating in Asia.”

Supply chain disruptions have eased considerably compared to 12 months ago. “Most manufacturers have broadened their vendor family and partnerships so there’s broader access to what you need,” says Turner.

Gray cites dramatic improvements in the supply chain, including getting materials from raw material suppliers and reduced transit costs. Between the calming of the supply chain and internal investments, Gray says Roto has been able to “greatly reduce our lead times to the market.”

Quanex expanded its supplier base so it’s less reliant on freight from China and Johnson also notices container and raw material prices easing. However, he notes Quanex, like many companies, purchased material in bulk in the past year to ensure it had sufficient materials and it is still working through that high-priced inventory.

Burns explains that AmesburyTruth continues to invest in redundancy in its own manufacturing and supply chain so key products are tooled in multiple locations. “To mitigate risk with raw material shortages, we are evaluating alternative options, including leveraging our own re-use materials. Long-term we are committed to shorter supply chains. That implies less reliance on overseas sources for both commodities and components.”

Certain materials, however, still present challenges. Picray notes glass in particular continues to be difficult to acquire, in part because of difficulty in the glass supplier obtaining raw material and in part because of the labor shortage. “It all adds up to us not getting glass as quickly as we used to, especially as these huge expanses of glass really start to take hold in the design space. It takes longer than other types of window sizes to get.” She says they’ve largely exited the lumber and aluminum shortages.

With easing materials shortages comes an increased expectation on companies to perform even better than before. “With lead times getting back in line, we are working with our customers on supply chain efficiencies,” says Peilert. “Especially with the lessons of the pandemic years fresh on their minds, they expect us to become a much more integrated part of their business. Quality, delivery and value remain the most critical expectations.”

Have you been put on allocation for materials?

- Yes 54%

- No 40%

- Prefer not to say 6%

Have you put your customers on allocation for materials?

- Yes 36%

- No 56%

- Prefer not to say 7%

How have you kept your supply chain healthy and moving?

- Bulk ordering far in advance

- Increase inventory holding

- Prompt payment

- Adding vendors

- Qualified new suppliers

- Adding vertical businesses

- Communication with customers and vendors

- Diversification of supply chain

- Maintain machinery

- Leverage global resources

Why are you planning to try a new supplier in 2023?

- Redundancy and cost

- New products and shorter lead times

- Increase supplier reliability

- Diversify

- Market expansion

- Lower backlogs

- Availability

Labor, Production and Investments

What is your biggest staffing challenge?

- Hiring 51%

- Retention 29%

- Training 13%

- Other 7%

Labor & Investments

68%

Added staff in 2022

78%

Added production capacity in 2022

45%

Plan to hire staff in 2023

For most companies, labor remains a top business challenge. Not only is it difficult to hire any new employees—let alone employees with existing industry knowledge—but retaining them is also a challenge.

In fact, 43 percent of survey respondents indicate they will invest in employee recruitment and retention and 37 percent plan to invest in training and education this year.

Employee engagement

Gray predicts the recruitment and retention difficulties may lessen as the economy pauses. “Hopefully that will be an upside where we can retain good people,” he says.

Johnson echoes that sentiment: “The slowdown will make it so it’s less of a struggle,” he says, specifically mentioning Quanex still working five days a week when others are slowing down or laying off, as well as boosted salaries and benefits.

“The key is to have a robust HR team and updated policies,” says Koch. “Over the past several years, we have bolstered our human resources team. We have a much larger and capable department, which allows us to have HR professionals with very focused missions to meet the larger organizational demand for talent. For example, we have individuals who specialize in recruiting, onboarding, training, benefits, safety and more.”

Koch also notes expanded marketing efforts in the community and engaging with local schools to educate students about careers in manufacturing. Retention efforts include comprehensive training and revisiting shifts, working hours and PTO policies to optimize work-life balance, as well as addressing compensation that meets workforce demands.

Roto invested in a Gallup survey for its employees and has analyzed the data and created teams internally to discuss what areas should be strengthened. The benefits of employee engagement, Gray explains, go beyond the employees—it also benefits the company itself and its customers. “If you have a highly engaged internal team, you have a much higher engagement and retention value with your customers.”

Peilert shares the starting point for hiring and retaining is to “have a compelling vision and embed it in every phase of the employment life cycle.” He points to Veka’s dual apprenticeship program, where Veka apprentices can obtain a fully paid-for associates degree while getting hands-on operation experience. Peilert also says Veka has more than 100 work time options in an effort to optimize flexibility.

Pella hired more than 4,000 people last year—a combination of attrition and growth—and currently employs over 10,000. Bringing in so many new people at one time can impact a company culture, and Picray says it was imperative to find a way to ensure everyone, from the new members to tenured team members, felt appreciated and engaged. As such, they launched the “We are Pella” campaign, which recognizes team members to keep their company culture alive and also show others that manufacturing is a worthy and rewarding career path.

Where do you plan to focus your investments in 2023?

*Respondents could select more than one option

- Employee recruitment and retention 43%

- Expand production capacity 41%

- Training and education 37%

- Marketing 30%

- Machinery purchases/upgrades 28%

- Software integration 24%

- R&D and testing 23%

- Expand locations 22%

- Business management software programs 20%

- Lean manufacturing 14%

- Other 3%

Investments

Nearly half of companies indicate they will expand production capacity. Some have already done so in the past year—and plan to continue doing so—by expanding their physical facilities. YKK AP America, for example, broke ground in October on a residential window and door manufacturing facility in Georgia, which will include modern equipment, increased production capabilities and some evolution of product quality attributes, according Turner. “Setting up the new facility will help us create a new platform to reach higher market share and more customer satisfaction,” he says.

Veka has spent more than $50 million in the past two years to boost capacity at its North American sites, says Peilert. “Moreover, we have also ensured our supply chain and staffing plans are aligned. We are well-positioned to support the growth needs of new and existing customers.” Energy Star Version 7.0 products, color strategies and impact windows are among the areas Veka anticipates helping its customers grow. “If the market pie shrinks, our goal is to help them secure a larger slice of market share,” he says. “The right product and service solutions are critical.”

Gray anticipates stronger merger and acquisition activity across the industry in the coming year. “Any time you have a downturn, those who are cash rich tend to have opportunities,” he explains. “Some companies that maybe didn’t navigate well through the pandemic might be in an over-leveraged state today, whereas some companies that have done really well might be heavy on cash and looking for investment opportunities to strengthen their footprint in the market.” In late 2022, Roto announced it acquired sealing products supplier Ultrafab.

Other the acquisition activity in 2022 included: Quanex acquired LMI Custom Mixing, Masonite acquired Endura Products, PGT Innovations acquired Martin Door, Centra Windows acquired Supreme Windows Calgary and Assa Abloy acquired four companies, including Caldwell, Alcea, VHS and Bird Home Automation. And those are just a fraction of the late 2022 industry acquisitions.

Veka plans to support its laminated offering by investigating more durable protective films, as well as adding lamination lines at two of its locations. “Another area we continue to invest in are our sales, order and planning capabilities,” says Seiling. “Having an integrated production and inventory approach with our customers pays dividends for everybody.”

Companies will continue to invest in automation. “With labor being where it is, more companies are going to automation,” explains Johnson. Not only does it reduce scrap, he says, it improves quality, reduces failures and saves on glass, labor and materials.

GED predicts its biggest business opportunity will be replacing old, obsolete equipment and providing more automation solutions, says Moore. Especially as business slows to more sustainable levels and companies are working on their businesses—rather just in them—there’s increased demand for new and upgraded machinery and software.

Those software upgrades can help companies optimize materials as well. GED’s Lookahead software, for example, coupled with the company’s CleanCut cutting tables allows companies to buy only what they need,” says Moore. It also launched the GED Productivity Improvement Program last year that is designed for Intercept customers that want to get more out of their existing equipment.

AmesburyTruth also invested in its internal operations in the past year, including new roll mill machines for its balance business, a new urethane line for the door seal market and new die cast and injection molding capabilities, says Burns.

Picray predicts as the market slows, companies will focus more on what customers need, such as increased transparency in delivery times. As such, the digital space is a key area of investment for the company. “Customer expectations in the past 2 ½ years have leveled up,” she explains. “People want real-time information at their fingertips for every kind of purchase you can imagine.” She references a popular pizza chain app where customers can see what step of the pizza-making process their order is in. “Customers are demanding that across the board in all types of categories,” she says. “Customers want to know and understand what step of the journey their orders are on.”

This is a continuation of Pella’s investment in its digital space, including its online pricing transparency. “Customers are using digital assets or tools for every kind of purchase they make today. Windows and doors are very complex strategy, but we need to be able to answer how customers want to shop,” she says.

Meet the Respondents

This year’s respondents hail from the supplier, manufacturer and dealer side of the residential fenestration business. Take a look at who shaped this year’s statistics.

About what percentage of your business was replacement versus new construction in 2022? (replacement/new construction)

- 100 percent replacement 16%

- 80/20 12%

- 60/40 17%

- 50/50 17%

- 40/60 14%

- 20/80 21%

- 100% new construction: 3%

About what percentage of your business is in residential windows?

- 100 percent 18%

- 75-99 percent 24%

- 51-74 percent 21%

- 50 percent 8%

- 30-49 percent 14%

- 10-29 percent 5%

- Less than 10 percent 7%

- None 4%

About what percentage of your business is in residential entry doors?

- 100 percent 11%

- 75-99 percent 8%

- 51-74 percent 7%

- 50 percent 4%

- 30-49 percent 4%

- 10-29 percent 20%

- Less than 10 percent 35%

- None 12%