2023 Top Manufacturers Report | A Year of Growth

Companies expand their capacity as backlogs decrease and sales increase

Photo courtesy of PGT Innovations

The economic landscape of the past year has been tumultuous, requiring companies in the building products industry to ride the ebb and flow. The companies on this year’s Top Manufacturers list do just that—navigate the economic waves at their highs and lows while continuing to prioritize customer service and growth while trailblazing innovation.

This year’s Top Manufacturers report examines the construction, building and manufacturing industries at large before diving into insights from the statistics from residential fenestration manufacturers, compiled using data from survey companies completed in March of this year.

The 2023 Top Manufacturers Report

- The Big Picture

New home construction, remodeling and manufacturing outlooks- The Residential Fenestration Market

Market conditions, sales, production, product trends, labor, automation- The Top Manufacturers Index + List

North America’s largest manufacturers of residential windows, doors, skylights and related products, based on sales volume

The May/June Digital Issue

More details about each of the 2023 Top Manufacturers on the List are available in the May/June digital issue of Window + Door Magazine along with more of their survey results.

The Big Picture

After much of 2022 saw decreased housing starts and low builder confidence, new housing construction figures are starting to creep back up. However, remodeling may be heading for a slowdown, according to industry forecasters. Economic concerns hamper both figures, and the manufacturing industry as a whole is also feeling the impact of a shaky economy, inflation and rising costs across the board.

New construction

Builder sentiment was cautiously optimistic in April as limited resale inventory helped increase demand in the new home market even as the industry grapples with building material issues. The NAHB/Wells Fargo Housing Market Index registered a one-point gain in April to 45. Although any number less than 50 is considered negative, it’s a significant gain from the November 2022 reading of only 33.

Overall, housing starts posted a decrease in March of 0.8 percent. The single-family sector is improving 2.7 percent, but it’s still 27.7 percent lower than a year ago. However, this is an improvement from February data, in which year-over-year figures were 31.6 percent lower than a year ago. “We expect choppiness for single-family construction in the months ahead, with the 2023 data posting significant year-over-year weakness before improving on a sustained basis,” says NAHB Chief Economist Robert Dietz.

Key takeaways

- Builder sentiment. One-third of housing inventory is new construction, compared with historical norms of around 10 percent. This, combined with fewer listings in the resale market, is giving builders an edge.

- Turning point ahead. “With builder sentiment climbing for four consecutive months and single-family starts continuing to move gradually higher from low levels since the beginning of the year, this indicates that a turning point for single-family construction will occur later this year after declines in 2022,” says Alicia Huey, chairman of the National Association of Home Builders

- Supply, labor challenges. Supply-chain struggles and ongoing labor shortages continue to challenge builders.

Remodeling

Remodeling, on the other hand, may be about to see a decline after more than a decade of continuous growth. The Leading Indicator of Remodeling Activity released by the Remodeling Futures Program at the Joint Center for Housing Studies of Harvard University projects that year-over-year homeowner improvements and maintenance expenditures will post a modest decline of 2.8 percent through the first quarter of 2024.

“Higher interest rates and sharp downturns in homebuilding and existing home sales are driving our projections for sluggish remodeling activity next year,” says Carlos Martín, project director of the Remodeling Futures Program at JCHS. “With ongoing uncertainty in financial markets and the threat of a recession, homeowners are increasingly likely to pare back or delay projects beyond necessary replacements and repairs.”

Key takeaways

- A slower pace of growth. The NAHB/Westlake Royal Remodeling Market for the first quarter of 2023 posted an increase in the Future Indicators Index and a slight decrease in the Current Conditions Index. NAHB says these figures are consistent with their projection that remodeling will grow in 2023 but slower than in 2022.

- Remodeling boons. Aging-in-place may be a strong sector for remodeling in the coming years, predicts NAHB. The JCHS at Harvard University also notes federal incentives for energy-efficiency retrofits may buoy remodeling and prevent it from steeper declines.

Manufacturing

The manufacturing industry’s top concerns revolve around tax, trade, permitting and regulatory proposals, according to the National Association of Manufacturers Q1 2023 Manufacturers’ Outlook Survey. Overall, the NAM Manufacturing Outlook Index rose four points from last December’s reading, though it remains just below the historical average.

Key takeaways

- Workforce struggles. Nearly three-quarters indicate attracting and retaining a quality workforce as a primary business challenge, with increased raw material prices and supply chain challenges as the next two biggest.

- Tax burdens. More than 90 percent said higher tax burdens on manufacturing income would make it difficult to expand their workforce, invest in new equipment or expand their facilities. Almost 94 percent said regulatory burdens would similarly burden them.

- Permit troubles. About three-quarters indicated permitting reform, which would simplify and expedite the approval process for new projects, would be useful in helping hire more workers, expand their business, and increase wages and benefits.

Photo courtesy of NT Window

The Residential Fenestration Market

91%

Experienced measurable, significant growth over the past five years

88%

Added production capacity in 2022

88%

Report higher sales compared to last year

Respondents to this year’s Top Manufacturers survey shared insights about sales, production, product trends, labor, automation and more.

Challenges, Opportunities

What will be major headwinds in 2023?

(Respondents could select more than one answer.)

- Inflation 48%

- Labor shortage 17%

- Material cost 14%

- Other* 12%

- Material availability 3%

- Evolving product designs 3%

- Backlogs 2%

*Includes interest rates, housing affordability, consumers being priced out of the market, market slowdown, rising energy prices

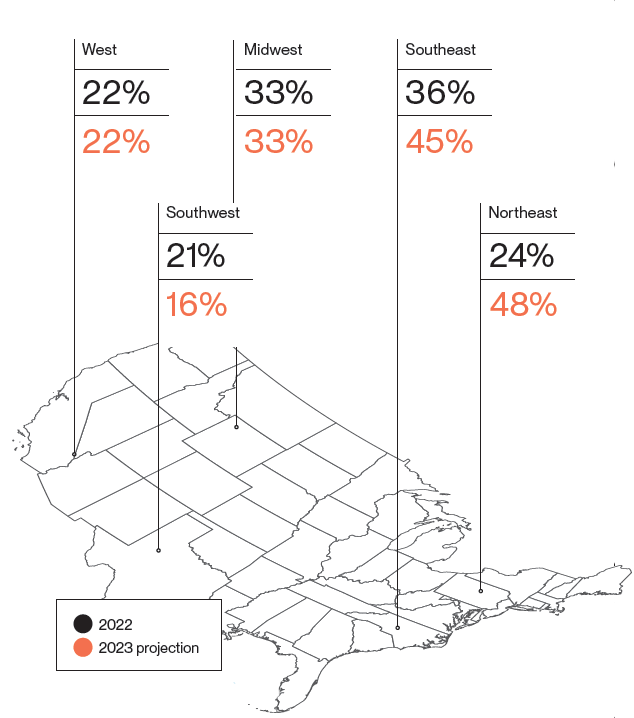

In which geographic markets did you see the most growth in 2022?

In which geographic markets did you see the most growth in 2022?

- Northeast 24%

- Southeast 36%

- Midwest 33%

- Southwest 21%

- West 22%

In which geographic markets do you anticipate the most growth in 2023?

- Northeast 28%

- Southeast 45%

- Midwest 33%

- Southwest 16%

- West 22%

What is your biggest business opportunity?

Respondents overwhelmingly indicated that expanding into new markets and geographic territories will be a big business opportunity in the coming year. Other business opportunity includes:

- Adding manufacturing locations

- Geographic expansion

- Thin glass IG automation

- Acquiring new customers

- Door systems

- Energy Star Version 7.0

- New colors and other customization options

- Maintaining strong customer relationships

- Growing dealer network

- Higher-end jobs

- Triple-pane windows

- Hiring good employees

- Impact-rated products

Products

72%

Plan to update products as necessary to meet Energy Star guidelines

82%

Report energy-efficient products requested by customers

46%

Considering triple pane to enhance energy efficiency

What are the top three features in products your customers are requesting?

- Energy-efficient products 82%

- Large windows/doors 71%

- Color 49%

- Customized products (includes hardware options, special finishes, etc.) 46%

- Impact-rated products 21%

- Sound abatement 18%

- Historically accurate products 13%

- Other 7%

- Smart and tech-enabled products 4%

As in past years, many manufacturers cite vinyl windows and patio doors as their primary products. This figure aligns with what Window + Door reported in the 2023 Industry Pulse survey, where vinyl windows were the top-most-demanded product by nearly three times as much as the next product category.

Much product development is happening on the energy efficiency side, especially as Energy Star Version 7.0 is set to take effect in October, which is causing many companies to evaluate their energy-efficient portfolio and decide where and how to upgrade as necessary.

Supply chain and materials

60%

Have made changes to their supplier partners

99%

Report rising material prices in the past year

44%

Report increased demand compared to last year

How deep is your backlog?

- 1-2 weeks 13%

- 2- 4weeks 24%

- 4-8 weeks 24%

- 12-16 weeks 1%

- Longer than 16 weeks 6%

Just over 70 percent of respondents reported their backlogs were shorter in 2022 compared to 2021 and about a fifth indicated the backlogs are about the same as the previous year. Only 6 percent said their backlogs are longer—a marked drop from last year’s report in which nearly half of companies indicated their backlogs were increased.

The pandemic upended the supply chain. This year’s survey indicates it is beginning to stabilize compared to the past couple of years. Although inflation, availability of some materials and prices challenge manufacturers, many can work around these challenges through diversifying supply bases, maintaining solid relationships and having hard-working supply teams to mitigate difficult situations.

Which materials are most challenging to source?

(Respondents could select more than one answer)

- Glass 43%

- Hardware and other components 38%

- Aluminum 24%

- Weatherstripping 24%

- Laminate 16%

- Other* 15%

- Vinyl 10%

- Sealants 9%

- Paint 6%

- Wood 4%

*Includes custom-sized tempered glass, thermal breaks, fiberglass resin and glass spacers

Of those that made changes to their supplier partners, the most oft-cited reasons included price increases, lack of supply, material delays, the desire to diversify the supplier base, sourcing new materials and the need for more innovative partners that will support growth. Those that didn’t change supplier partners indicated strong relationships keep the relationships going. “Over the years, we have built strong relationships with our supply partners, and during the supply chain challenges, we worked with them instead of abandoning them,” writes one respondent. “This strategy has paid off for us.”

Labor

50%

Report more difficulty finding workers in 2022 compared to 2021

84%

Plan to hire new workers in 2023

53%

Recruitment is biggest labor challenge

What are your most effective employee recruitment strategies?

(Respondents could select more than one answer)

- Referrals 79%

- Other 21% (Includes agencies, social media, job boards, open interviews and location signage)

- Job fairs 17%

- Partnerships with local schools 7%

- Signing bonuses 7%

The skilled labor shortage continues to be a mighty obstacle for companies and perhaps this year is replacing the supply chain as companies’ top challenge.

Top challenges when training new employees include a lack of desire to learn new skills, language barriers, a changing demographic, difficulty in employee attendance reliability and soft skills.

Finding the correct trainer and having a sufficiently long training window is important but difficult to come by. “Developing a strong enough training program and resisting the urge to just throw people onto the floor” is one challenge, writes one manufacturer. The custom nature of fenestration products also adds to training challenges.

New hires often are also new to a manufacturing environment, so not only do the employees need to learn fenestration specifics but they also need to learn about manufacturing in general. Adaptability to change is also a factor. “Getting them used to the fast-paced production line and adapting when our processes change is a challenge,” one respondent writes. “We are continuously improving our processes and it can be hard to keep up.” Training also expands beyond hard skills. “Our company culture is very important to us, so a challenge or growth opportunity is ensuring there is equal exposure and understanding to culture and organizational values at every level,” writes one respondent.

“Balancing efficiency with thoroughness, adapting to individual learning styles and keeping pace with the evolving demands of the business,” are key considerations, writes another company.

What are your most effective employee retention strategies?

(Respondents could select more than one answer)

- Competitive salaries 76%

- Opportunity for advancement 55%

- On-the-job training 47%

- Increased benefits 47%

- Education incentives 14%

- Other 9% (Includes flexible work shifts, good company culture and European employment rules such as maternity leave, holidays, health insurance, etc.)

Automation

84%

Employ automation in their factories

33%

Brought more operations in-house in 2022

50%

Plan to add automation in 2023

What are the benefits of automation?

- Increased output 34%

- Increased quality 33%

- Labor savings 23%

- Cost savings 17%

- Operational transparency 10%

- Other 3%

Planned automation includes screen line, cutting for frame and sashes, glass, assembly, saws, cranes, welders, cleaner and IG manufacturing, among others. Some companies are also exploring automation for oversized products, which will better support employees. Yet others plan to add automation through shipping and scanning processes.

Although the majority did not bring operations in-house in 2022, those that did cite significant benefits such as more IGU production, screens and painting. One respondent invested in an additional laminating machine for more capacity, yet others added glass tempering capabilities. “It was already a challenge to get tempered glass,” writes one respondent. “As codes become more strict, tempered glass will be spec-ed more often.”

Photo courtesy of Marvin

The Top Manufacturers Index

The Top Manufacturers list details North America’s largest manufacturers of residential windows, doors, skylights and related products, based on sales volume

More than $1 Billion

- Andersen Windows & Doors

- Cornerstone Building Brands*

- Jeld-Wen

- Marvin Windows and Doors

- Masonite

- MITER Brands

- Pella Corp.

- PGT Innovations

- Velux USA*

- Wintegra Windows Inc.

- YKK AP America Inc.

$500 to $1 BILLION

$300 Million to $500 Million

$200 Million to $300 Million

- Champion*

- Kolbe & Kolbe Millwork Co.*

- ODL

- Polaris Windows & Doors*

- Quaker Windows and Doors

- Weather Shield Mfg.*

$100 Million to $200 Million

- All Weather Windows

- Boral Windows LLC*

- Crystal Window & Door Systems

- Earthwise Group, LLC

- Elevate Windows and Doors

- Fenplast

- Lindsay Windows

- Loewen Windows and Doors

- Lux Windows and Doors

- Midway Windows & Doors

- Plastpro*

- Simpson Door Co.

- Trimlite

- Trinity Glass International*

- United Window & Door Mfg.

- Vinylmax Windows

- Viwinco Inc.

- Wincore Windows and Doors

- Window Designs Group*

$75 Million to $100 Million

- Air Master Windows and Doors

- Arcadia Custom

- Centra Windows

- Durabuilt Windows & Doors

- Hayfield Window & Door Co.

- Lincoln Windows & Patio Doors

- Regal Aluminum Windows & Doors Inc.

- Skyline Windows

- Thompson Creek Window Co.*

- Wallside Windows

- WinDor*

- Window Mart*

- ViWinTech Window & Door Inc.

- Vytex Windows

$50 Million to $75 Million

- Builders FirstSource*

- Castle Windows*

- Conservation Windows*

- Gerkin Windows and Doors

- LePage Millwork

- Mathews Brothers Co.

- North East Windows USA Inc.

- NT Window Inc.

- Premium Windows

$40 Million to $50 Million

- ATI Windows*

- Croft LLC*

- Frontline Building Products

- GlassCraft Door Co.

- Hope’s Windows Inc.*

- International Window Corp.

- Okna Windows Manufacturing*

- Solaris International*

- Sun Windows Inc.

- The Coeur d’Alene Window Company*

- Vector Windows & Doors

$30 Million to $40 Million

- All Weather Architectural Aluminum*

- Comfort View Products

- Euroline Steel Windows

- Interstate Window & Door Co.

- Joyce Manufacturing Co. Inc.

- Madero*

- Stanley Doors*

- Taylor Entrance Systems*

$20 Million to $30 Million

- Alpen High Performance Products

- Everlast Group of Companies

- Gilkey Window

- Ideal Window

- Inline Fiberglass Ltd.*

- Moss Supply Co.

- Vinyl Kraft Inc.

- Winchester Industries

$15 Million to $20 Million

- Assura Windows and Doors*

- Climate Solutions Windows & Doors

- KHPP Windows and Doors

- Klar Studio Inc.

- Thermal Windows Inc.

- Upstate Door

Less Than $15 Million

The Top Manufacturers List

The full Top Manufacturers list details North America’s largest manufacturers of residential windows, doors, skylights and related products, based on sales volume. The list includes more information about product lines and is available in the May/June issue of Window + Door Magazine.

More from the Top Manufacturers

View photos from the Top Manufacturers on Facebook.